August 1st, 2018, marks the 50th anniversary of the National Flood Insurance Act, the guiding legislation of the National Flood Insurance Program. David Marsh, the chief executive of the Federal Emergency Management Agency's National Flood Insurance Program, shared some insights about the program's history and future. The program was created with the National Flood Insurance Act on August 1st, 1968. However, its foundations can be traced back to the 1927 Midwest floods, which were among the most devastating flood disasters in U.S. history. Throughout the 30s, 40s, and 50s, numerous administrative and legislative proposals were discussed to address the nation's flood risk. The urgency increased after the 1965 Hurricane Betsy, which emphasized the need for a comprehensive program that involves both the private sector and community participation. Reflecting on the 50th anniversary, David Marsh expressed the program's significance. Over the past five decades, the National Flood Insurance Program has served more than 22,000 communities, providing floodplain management and building code protection to those who choose to participate. The program currently offers flood insurance protection to over 5 million policyholders, ensuring that individuals and businesses have the means to recover from flood disasters. This resilience benefits both the policyholders and their communities. Marsh acknowledges the dedicated individuals, both in the public sector and the private sector, who have contributed to the success of the program. The National Flood Insurance Program has always been a strong public/private partnership. Presently, it relies on 63 leading property insurance companies to administer the program on its behalf. Additionally, a few vendors support these companies and help deliver the program to the American public. This collaboration has been pivotal in providing effective flood insurance coverage in the nation.

Award-winning PDF software

Fema 86 22 feb 11 Form: What You Should Know

Disaster Response & Response Assistance; (13) Staffing Resources for Adequate and Reasonable Disaster Assistance; (14) Staffing Resources for Adequate Disaster Assistance; (16) The Future of State Emergency Management Grants as Section 4302 of Title 42 (Sec. 42-4302) of the Code; and (17) A Review of the Department's Reassurances Policy (18) Review of the National Flood Insurance Program; and (19) Review of the Federal Emergency Management Agency's Disaster Support (20) Review of the Small Business Administration's Disaster Fund Request for Information on the National Flood Insurance Nov 22, 2025 — This information includes all information requested in the RFI; Request for Information on FEMA Programs, Regulations, and Apr 22, 2025 — FEMA is requesting information from the private sector on its proposed requirements for the implementation of its National Flood Insurance Program for the future. The information is a response to the requests in this RFI; Request for Information on FEMA Programs, Regulations, and Apr 22, 2025 — FEMA is asking for comments on the National Flood Insurance Program, the Administration's efforts under the National Flood Insurance Program, and current and future programs authorized by the National Flood Insurance Program. (The requests in this RFI are numbered in increments of 101 – 120 and will be published in the Federal Register as 111–122 and 128–143.

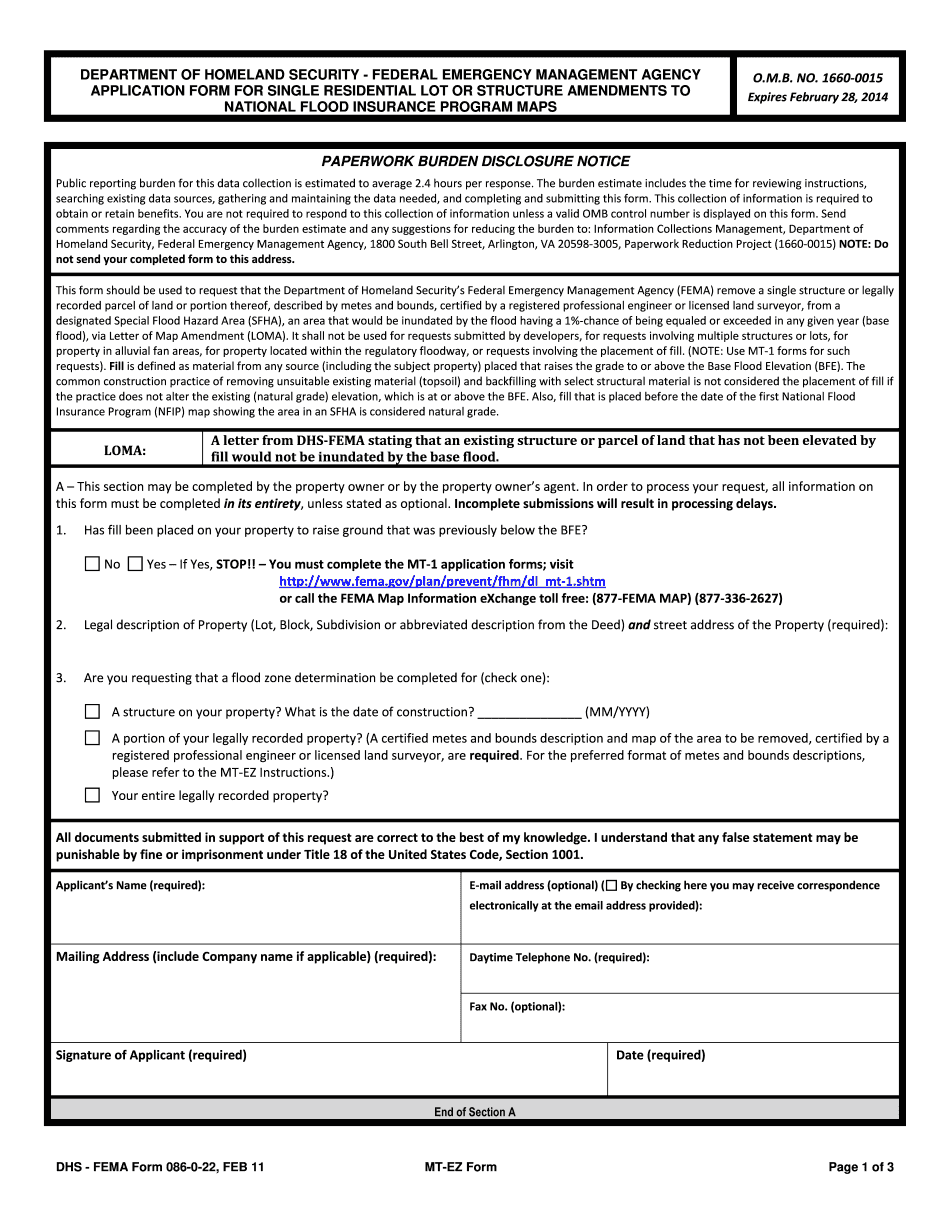

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 86-0-22, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 86-0-22 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 86-0-22 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 86-0-22 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fema form 86 22 feb 11