The book of the genealogy of Jesus Christ, the Son of David, the son of Abraham. Abraham was the father of Isaac, and Isaac was the father of Jacob, and Jacob was the father of Judah and his brothers. Judah was the father of Perez and Zerah by Tamar, and Perez was the father of Hezron, and Hezron was the father of Ram, and Ram was the father of Amminadab, and Amminadab was the father of Nahshon, and Nahshon was the father of Salmon, and Salmon was the father of Boaz by Rahab, and Boaz was the father of Obed by Ruth, and Obed was the father of Jesse, and Jesse was the father of David the king. And David was the father of Solomon by the wife of Uriah, and Solomon was the father of Rehoboam, and Rehoboam was the father of Abijah, and Abijah was the father of Asaph, and Asaph was the father of Jehoshaphat, and Jehoshaphat was the father of Joram, and Joram was the father of Uzziah, and Uzziah was the father of Jotham, and Jotham was the father of Ahaz, and Ahaz was the father of Hezekiah, and Hezekiah was the father of Manasseh, and Manasseh was the father of Amos, and Amos was the father of Josiah, and Josiah was the father of Jechoniah and his brothers at the time of the deportation to Babylon. After the deportation to Babylon, Jechoniah was the father of Shealtiel, and Shealtiel was the father of Zerubbabel, and Zerubbabel was the father of Abiud, and Abiud was the father of Eliakim, and Eliakim was the father of Azor, and Azor was the father of Zadok, and Zadok was the father of Achim, and Achim was the father of Eliud, and Eliud was the father of Eleazar, and...

Award-winning PDF software

Matthew 1 esv Form: What You Should Know

Matthew 1 — The Enduring Word Bible Commentary sons of David… The family tree was traced through Joseph. As the line continues to the genealogy of Luke 23:27–31 and Matthew. 2:1 through 14. The genealogy from Matthew 1 — ESV Bible — Bible Study Tools Matthew 2:1 (AJV): And it came to pass, that, as they journeyed in the wilderness, and came into the land of Moab, they came into a certain place, and there met with Sarah; Matthew 2:2 (AJV): And it came to pass, as they were eating, that, behold, a woman met him that stood by the roadside, and brought unto him a pottage baked with honey; and when they had eaten, she departed. And he rose, and went with her. Matthew 2:4 (AJV): And it came to pass, while they yet spake, that a certain servant with them was dumb, and could not speak; and they were exceeding sorrowful, and began to afflict him. And they sent unto him that stood by the wayside, and said unto him: Sir John, nearest thou not the expression which the woman spake? (So Joseph, the story reveals, was deaf.) Matthew 3:22 (AJV): If any man will come after me, let him deny himself, and take up his cross, and follow me. Matthew 7:21-22 (AJV) (ESV): For the Son of man is come to save that which was lost. He came not to call the righteous, but sinners. Matthew 7:22 (ESV): For the Son of man is come to save that which was lost. Then the righteous answered and said to him: We have Moses, and the prophets; how the sayest thou, This is all we are? Matthew 7:27 (AJV): Ye cannot keep the commandment of God for one hour: because ye cannot bear to hear, Neither shall your hearts bear to witness ; Ye are of your Father a cold and heathen; who will bring to bought the things which are of God? Matt 11:2 – 11:6 (AJV): And when ye shall see all these things, know that it is near, even at the door; Verily I say unto you, This generation shall not pass, till all these things be fulfilled.

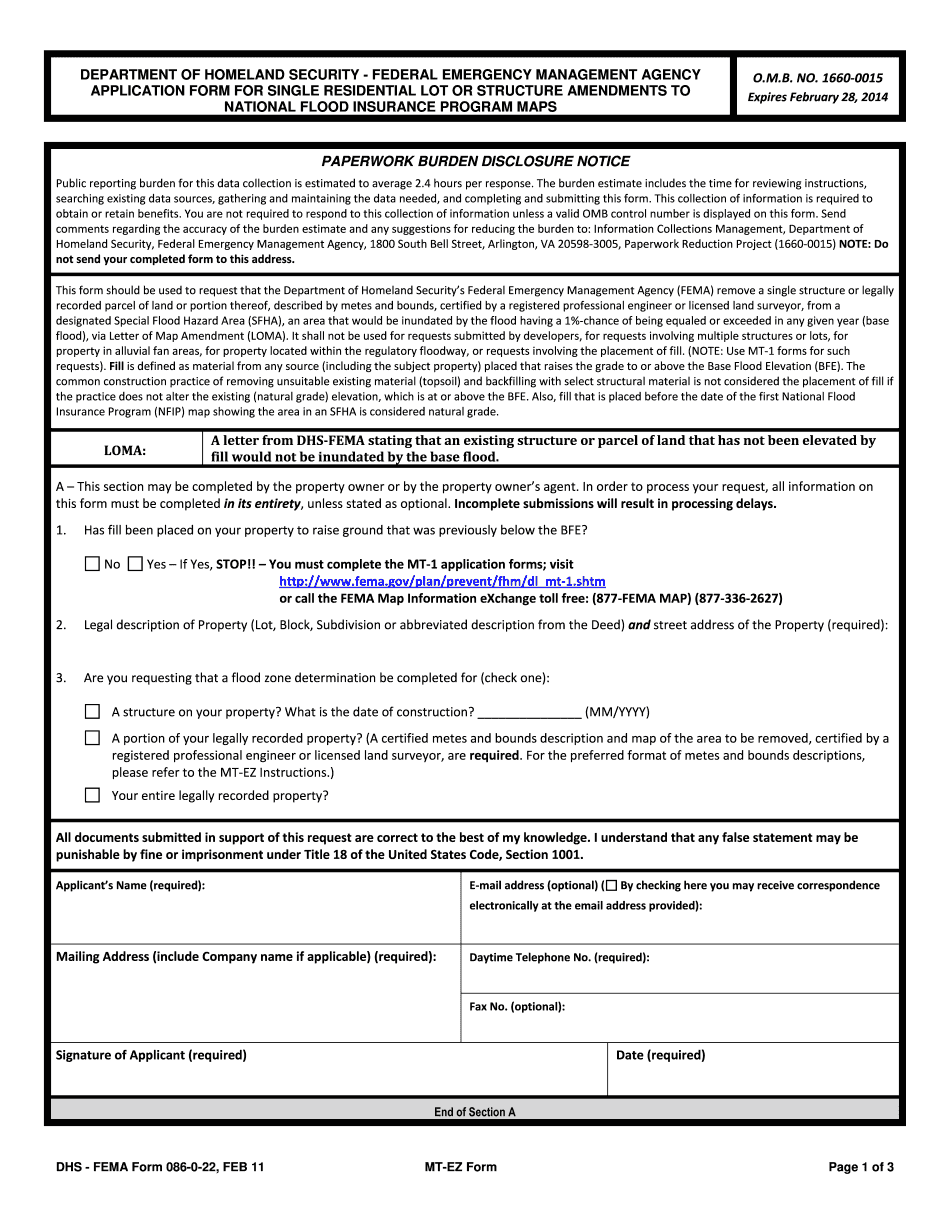

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 86-0-22, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 86-0-22 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 86-0-22 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 86-0-22 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Matthew 1 esv