I am very grateful to the distinguished senior senator from New Jersey for joining me again this week. We are bringing attention to the challenges that climate change and rising seas pose for our coastal communities, specifically in our states of New Jersey and Rhode Island. Both states experienced the unforgettable impact of superstorm Sandy, which wreaked havoc on our shores due to higher tides and warmer oceans. In New Jersey and Rhode Island, we understand the vulnerability we face as sea levels rise and storms become more intense. That is why we believe the National Flood Insurance Program should be one of our government's best tools in educating and preparing our communities for the changes driven by carbon pollution. However, the program falls short of this goal. Instead of addressing the program's shortcomings head-on before the next big storm, we seem to be pushing the issue aside once again. As a resident of Rhode Island, I know firsthand how crucial it is to take action. Despite being smaller than New Jersey, my ocean state has 400 miles of coastline that are threatened by sea level rise and storm surge flooding. Simply promising to address these issues eventually is not enough. Our coastal risk is growing, not shrinking. Even in an optimistic scenario of only 6 feet of sea level rise, a 2017 Zillow chart showed that over 4,800 homes in Rhode Island, valued at nearly 3 billion dollars, would be underwater by 2100. However, our state's Coastal Resources Management Council predicts that Rhode Island could see up to 9 to 12 feet of sea level rise by then. New Jersey, with its larger shoreline, has even more at risk, with over 93 billion dollars worth of property predicted to succumb to rising sea levels. This problem cannot wait until the year 2100. Its...

Award-winning PDF software

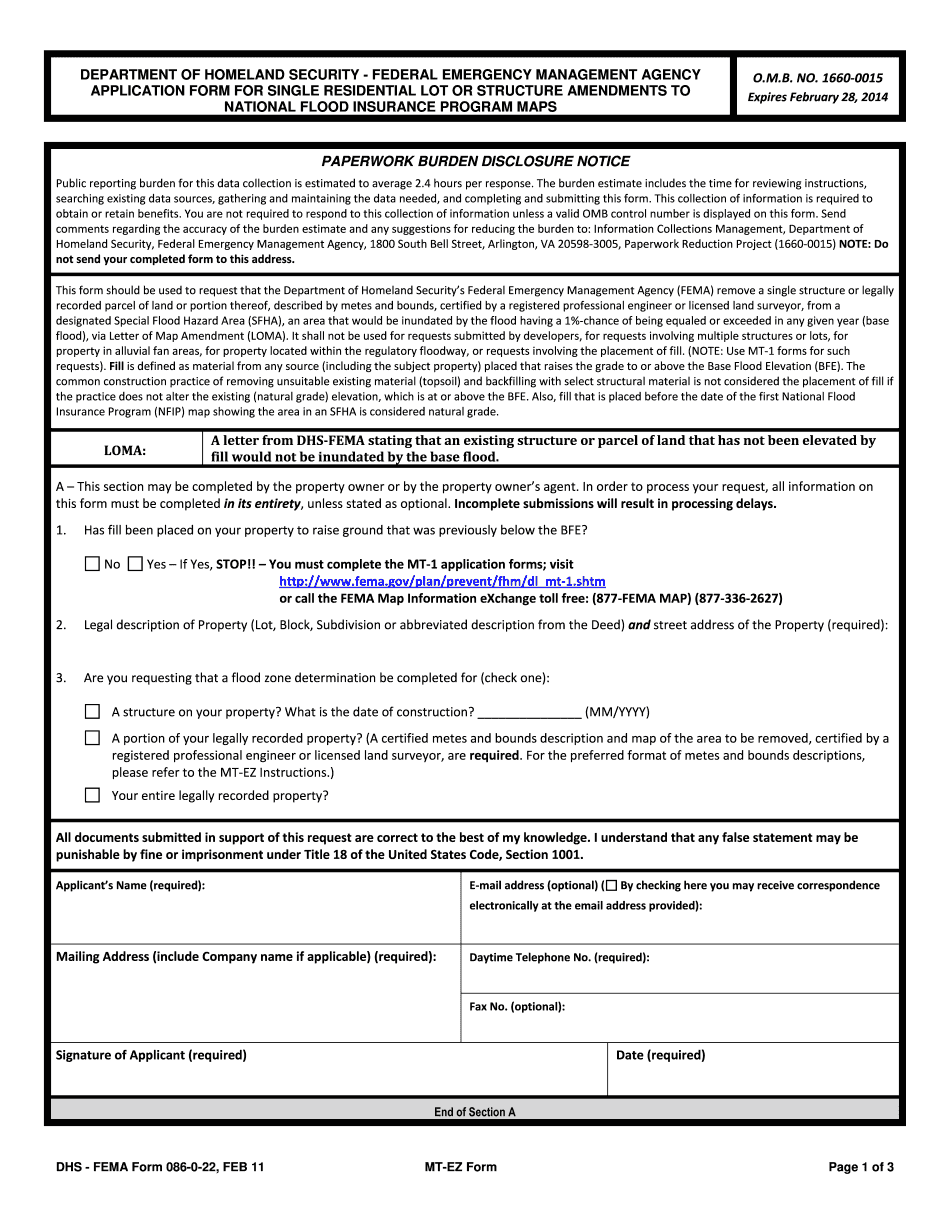

Dhs fema 86 26 feb 11 Form: What You Should Know

It takes up to 24 hours to process a request to determine if FEMA has issued a disaster loan. Form Description (04/29) This form should be used to request that we issue a flood hazard determination. Please allow up to 7 business days to process the request. The standard form should be filled out online to the best of my ability. The specific form used is FEMA Form 085-B-18, FEMA Hazard Determination Information Sheet. The specific form used in the form is FEMA Form 085-B-19, Flood Hazard Determination Information Sheet. Please note there is a delay of up to 11 business days before a request can be processed. FF-086-0-34. (06/06). FEMA. Civil Defense Administration. FEMA. National Flood Insurance Program. A flood hazard determination is an official determination. FEMA's National Flood Insurance Program form is required to be completed and given to the applicant. FF-086-0-35. (06/24). Federal Emergency Management Agency. Federal Emergency Management Agency. Washington, DC. The standard flood hazard determination form is required to be filled out and given to the borrower. (01/23) This is a letter from DHS-FEMA to the applicant and/or lender requesting an explanation of how a specific claim for assistance is related to the flood hazard determination (FAHD Form 086-07-30). U.S. DEPARTMENT OF SOCIAL SERVICES Bureau of Indian Affairs Form Description (11/20). U.S. DEPARTMENT OF HUMAN SERVICES. Bureau of Indian Affairs. American Indian and Alaska Native Housing Tax Assistance (AI/ANTI). For assistance in paying an arbitrage in a housing loan or providing foreclosure relief, applicants must complete Form 15-20-20. In addition, applicants must complete Form 17-20-10 to claim exemption from taxes. For assistance in paying an arbitrage in a housing loan or providing foreclosure relief, applicants must complete Form 15-20-20. This form is also filled out online. The Standard Form for Federal Housing Administration Loans for Native American Housing for which assistance is claimed is found on Form 17-12-18. A copy is completed for each applicant to ensure a complete loan file.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 86-0-22, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 86-0-22 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 86-0-22 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 86-0-22 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dhs fema form 86 26 feb 11