Joseph, the stand-in father, will be considering the story of Joseph as found in Matthew chapter 1, verses 18 through 25. If you haven't already, please pause right now and have somebody in your group read that passage. The Gospel of Matthew begins with a detailed genealogy, beginning with Abraham and tracing through David, Israel's greatest king. It concludes with the words in verse 16, "Joseph, the husband of Mary, of whom was born Jesus, who is called Christ." The genealogy traces Jesus' lineage back to David, placing him in line for the ultimate kingship as the Messiah, the Anointed One, the heir to David's kingdom who would rule over the kingdom of God forever. But it's not that simple. Since Jesus was born of a virgin mother, not of Joseph's seed at all, was Jesus really a descendant of David? After all, it's pretty clear from what is not said in Matthew that his readers were familiar with the story of the virgin birth told in Luke's Gospel. Matthew's account, on the other hand, is told from Joseph's perspective. Matthew begins simply in verse 18, "This is how the birth of Jesus Christ came about: His mother Mary was pledged to be married to Joseph, but before they came together, she was found to be with child through the Holy Spirit." Notice he just states simply the facts of what his readers already knew, without embellishment. 1. Mary and Joseph were betrothed to each other, but they had not come together, that is, had sex with each other. 2. Mary had begun to show she was pregnant, for the conception was from the Holy Spirit, not man. We knew these things, and so did Joseph. Except for the story, it is familiar to us. But let's examine it in detail so that we...

Award-winning PDF software

Matthew 1 commentary Form: What You Should Know

Matthew 1 ‐ Smith's Bible Commentary — Sunlight.org The Father, and the Son, and the Holy Spirit, and Jesus Christ, were the three persons of the Godhead. The first of these persons was always with us in the person of the Godhead, for He is the Creator and Maker, the Spirit and Power, and the Power, and Father of all things in Heaven and on Earth. The second of these persons was with us in the person of the Father, on account of His having been before the Son of God a Man; the Son is the Mediator of the Father, but the Father, having come from eternity, was with them before the creation of the world; the Holy Spirit, who, when He came with Christ, and had begun to dwell with Jesus as a Spirit, and not a man, being at once a Man and a Spirit, descended and took His leave of Christ as with a Spirit. The third of these persons was with us in the Person of God the Father, being the Father of all men. The fourth of these persons was with us in the Person of the Father, and the Spirit, and Jesus Christ, whom He had chosen to be the Mediator of all. All the others were of course His ministers and servants, to whom He gave to share and to partake of His glory and blessings, and so He was their God and Father, and with whom they are or should be conformed as men in His kingdom, which He had prepared by His Son Jesus Christ, in the latter-day of the world. The first of these four persons, Jesus of Nazareth, has been called the Christ for a reason; if He had not been the Christ, the Son of God, He would not have received the name Jesus; therefore He received it, because He was both the Christ and the Son of God, and the only-begotten of the Father. And if the Father sent the Son as the Holy Spirit, this Holy Spirit is sent to carry about, to accomplish, and to accomplish the Father's purposes; and so, according to this account, it was said that the Holy Spirit was sent into the world to teach men to believe the Son of God; and the first three members of the Trinity teach all men in the name of the Father, while Christ the Only-begotten teaches them in the name of the Son.

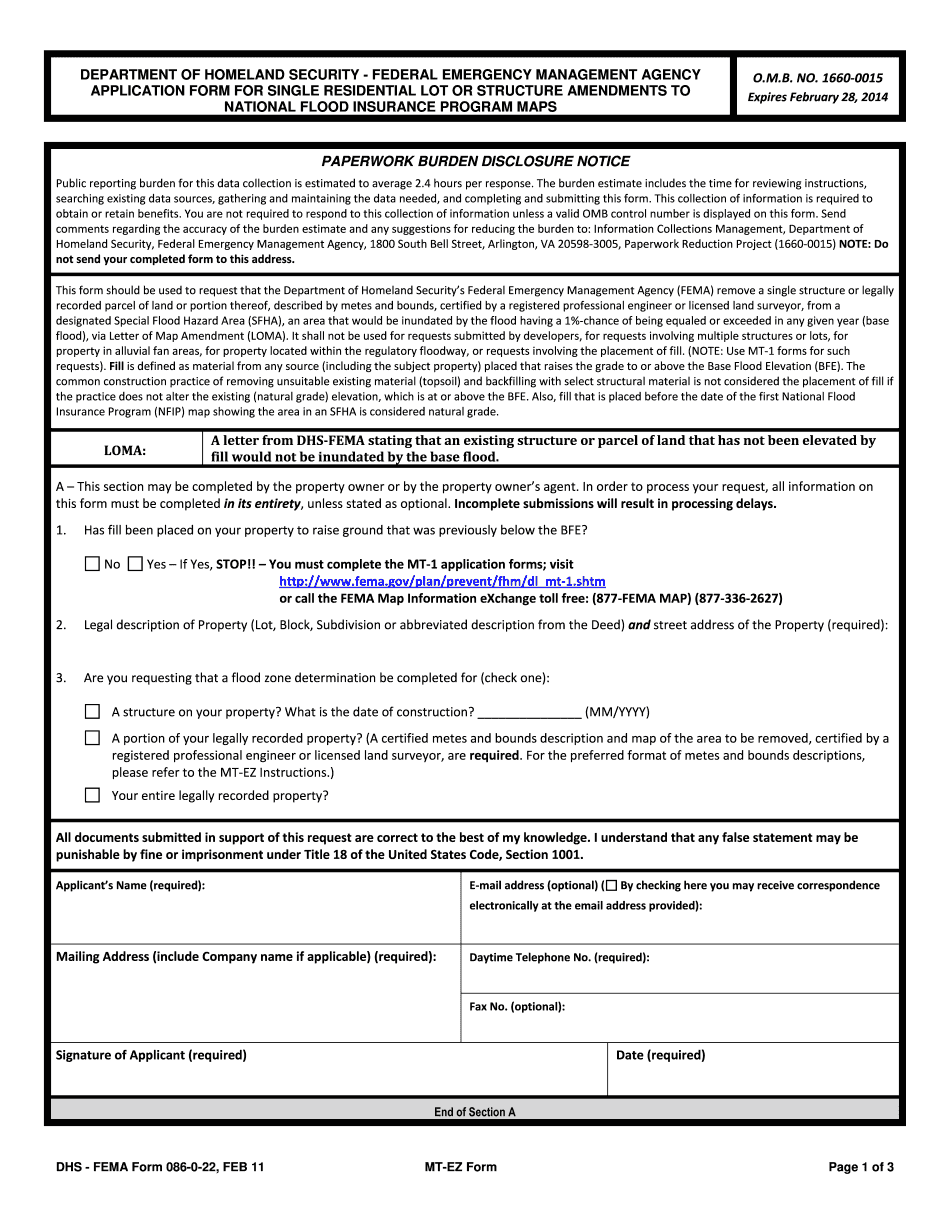

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 86-0-22, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 86-0-22 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 86-0-22 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 86-0-22 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Matthew 1 commentary