So let's talk about the "write your own" program. We've got a little over 70 plus companies that have an agreement with FEMA to write policies for policyholders in participating communities and service the National Flood Insurance Program in their own name. So, even though it's underwritten by the NFIP, policies may be under the company's name. They operate as part of the National Flood Insurance Program and are subject to the rules and regulations set by FEMA, including rates and policies. The companies will write the policies in the same way they do for their regular lines of business and they will also handle claims in the same way. However, they have to report their information to FEMA and we monitor them on a regular basis. The direct side of the program is a little bit different. It is a contract that we issue every year, or maybe every five years. It allows insurance agents to either write through a write your own company or write through the direct side. The direct side also handles the policies for our severe repetitive loss properties, which are properties that have suffered certain kinds of losses. We want to keep those properties in one place to provide assistance and advice to direct side agents and adjusters. We provide this assistance via a direct servicing agent. It allows agencies to create quotes, submit applications, and view policy information, just like they would with the write your own company. One of the very important concepts we have in the National Flood Insurance Program, which, by the way, is a voluntary program, is community participation. In order for flood insurance to be written in any community, the community has to make an application and adopt a floodplain ordinance or a court order if they are in a...

Award-winning PDF software

Fema 86 22 Form: What You Should Know

The “Emergency and Major Disaster Grants Program” (IMP). The program is administered by the Federal Emergency Management Agency (FEMA) (see section 603.3(h) of the Stafford Act, 42 U.S.C. 5183(h))... 86 FR 21112 — Contents. . . . . . . 88 FR 28107 — Contents. . . . . . . November 2, 2025 — Implementation of the Federal Flood Insurance Program This document is made available for the guidance of Federal, State, and local officials in carrying out their responsibilities under state and Federal laws, regulations, and other policies with regard to the implementation of FIP. The document is not advisory. 86 FR 21317 — Contents. . . . . . . . 86 FR 21317 — Contents. . . . . . . . Notice of Special Requirements — FEMA Form 86-0-49: This form is used to request information on the amount of flood insurance to be taken out. For information on eligibility, see section 803.2 of the Stafford Act, 42 U.S.C. 5183a(1) . 86 FR 21328 — Contents. . . . . . . . Notice of Special Requirements — FEMA Form 86-0-49: This form is used to request information on the amount of flood insurance to be taken out. For information on eligibility, see section 803.2 of the Stafford Act, 42 U.S.C. 5183a(1) . 86 FR 21333 — Contents. . . . . . . . Notice of Special Requirements — FEMA Form 86-0-49: This form is used to request information on the amount of flood insurance to be taken out. For information on eligibility, see section 803.2 of the Stafford Act, 42 U.S.C. 5183a(1) . 86 FR 21345 — Contents. . . . . . . . . Notice of Special Requirements — FEMA Form 86-0-49: This form is used to request information on the amount of flood insurance to be taken out. For information on eligibility, see section 803.2 of the Stafford Act, 42 U.S.C. 5183a(1) . 86 FR 21350 — Contents. . . . . . . .

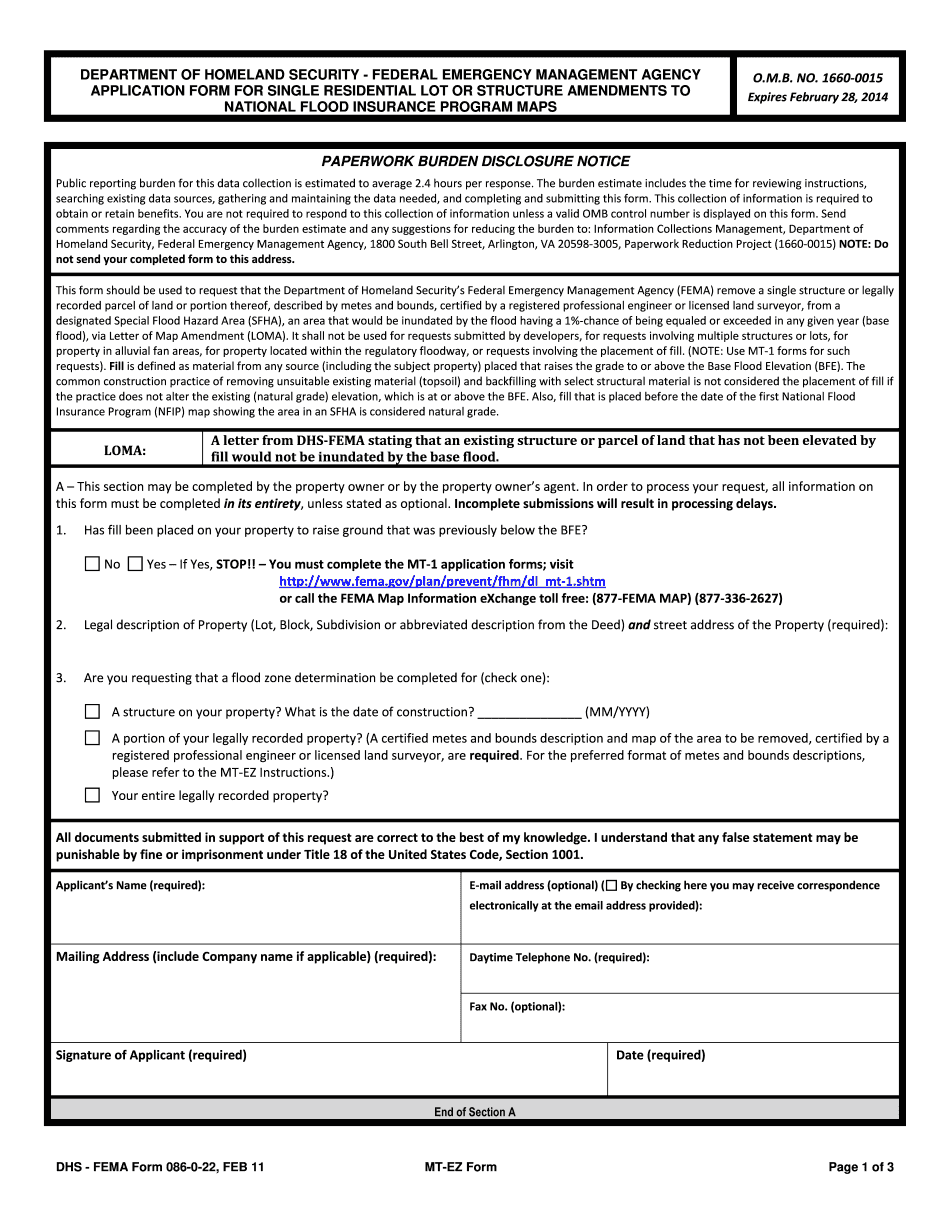

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 86-0-22, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 86-0-22 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 86-0-22 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 86-0-22 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fema form 86 22