Award-winning PDF software

Standard flood hazard determination 2025 Form: What You Should Know

Risk Based Flood Insurance Rate Increases — FEMA Here are some Frequently Asked Questions for this new FEMA risk fee program. The standard flood risk fee system is now in place, and for 2025 the maximum fee is 10,000 and the annual fee will be 5,000, for a total of 30,000. The FEMA Risk Fee is the only fee required for the Federal National Flood Insurance Program. To apply for a loan, you must use the FEMA Risk Fee Calculator on our website to calculate the risk fee. For more information, or to apply for a loan, visit this link: Risk Fee Calculator. New Standard Flood Hazard Determination Form (DDS) — FEMA On May 17, 2014, we received this notice from the U.S. Department of Homeland Security. The newly approved DDS is now a requirement for Federal home loan products. If you are looking to apply for a loan or modification for a federally backed program, it is your responsibility to be aware of the changes to the approved DFF. On August 17, 2017, FEMA finalized a rule requiring borrowers to have an approved application for all federally backed residential and commercial loans. In addition, the form is also accepted for federally backed student loans. For more information, visit these links: FEMA Form 088-0-30 (for federal loans) and FEMA Form 089-0-70 (for federal loans) Standard Flood Hazard Determination Form — CFPB This form can be filled out online. For additional information about the new FEMA standard flood hazard determination form, you can read about it from the Office of the Comptroller of the Currency and Federal Housing Finance Agency (CFPB). As a borrower, you have to understand the new standards that are now becoming a part of the loan process at the FHA. Here's info on what this means for you. FEMA Forms 090-0-01 to 090-0-05 and 090-0-15 through 090-0-20 are used to determine whether you have a federally backed loan with loan amount of 1,000,000 or less.

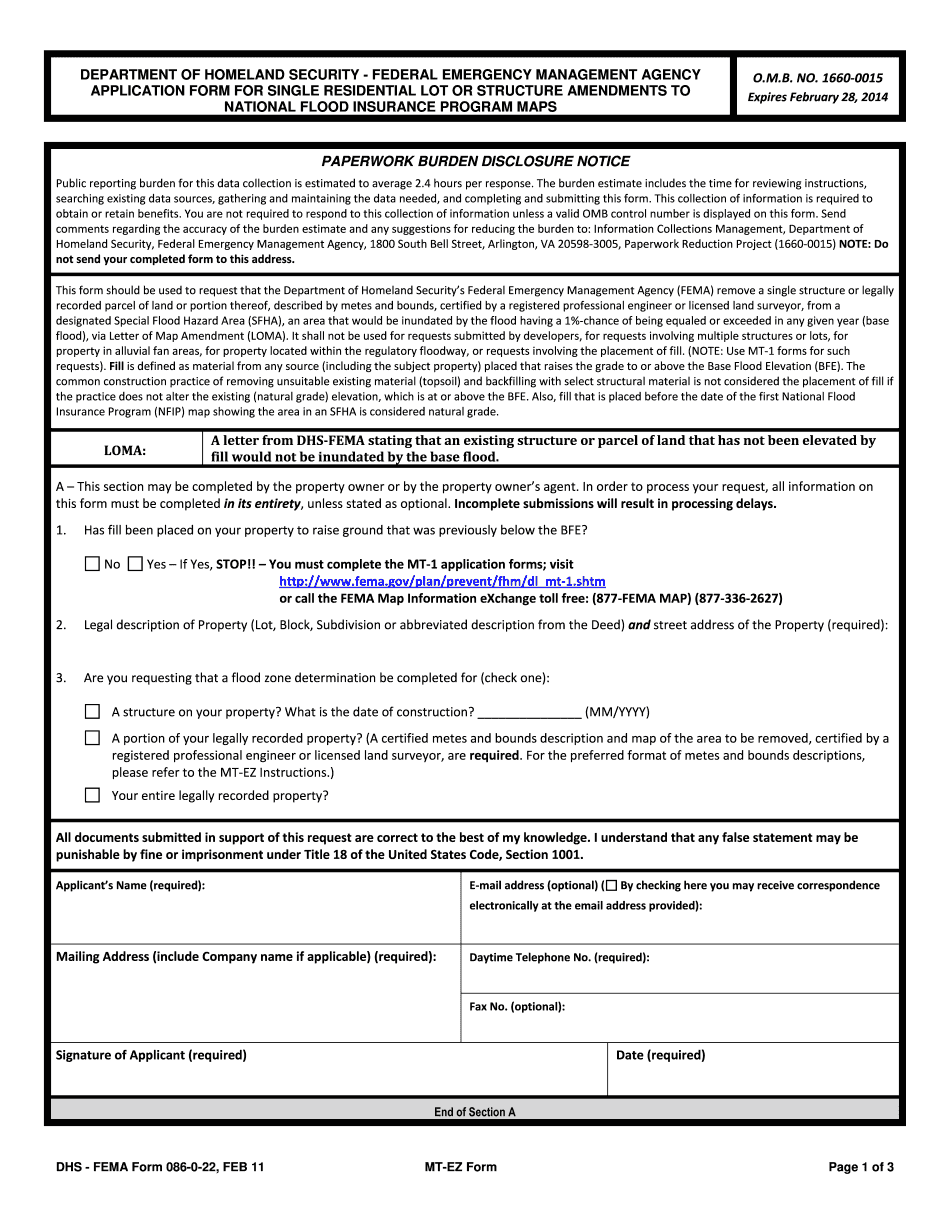

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 86-0-22, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 86-0-22 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 86-0-22 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 86-0-22 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.